Answers: Chapter 14 - Understanding Mutual Funds

14.1: True or False. A mutual fund can be described as an investment in a collections of stocks, bonds, or other financial instruments. The correct answer is True.

14.2: True of False. Mutual funds have their own stock symbols just like stocks. The correct answer is True.

14.3: A fund's portfolio manager is responsible for which of the following activities:

Selling and substituting the securities in the mutual fund

Filing taxes on your behalf associated with your profit in the mutual fund

To guarantee that you do no lose any money in the mutual fund investment

The correct answer is #1

An actively managed mutual fund has a portfolio manager who watches the fund carefully to determine whether to buy or sell the fund’s assets.

Answer #2 is incorrect because it is up to you (the investor) - not the portfolio manager - to file the taxes that you owe on any profits earned from the mutual fund.

Answer #3 is incorrect also; actively managed funds can lose an investor money.

14.4: The annualized total return is one way mutual funds do which one of the following choices:

Show how well they have performed financially in the past

Show how well they will perform in the future

The correct answer is #1

Studies show that future returns can be quite different from historical returns.

14.5: Mutual funds can be a good way to invest in stocks and bonds for which of the following reason:

Because a mutual fund buys and sells large amounts of stocks and bonds (and other financial assets) at a time, its costs are often higher than what you would pay on your own

By owning shares in a mutual fund instead of buying individual stocks or bonds directly, you spread out your investment risk.

Mutual funds can guarantee the amount of money you can make in your investments.

The correct answer is #2

A mutual fund's portfolio is comprised of a range of assets, offering some degree of diversification and therefore spreading out the investment risk.

14.6: The Net Asset Value per share or NAV can best be described as which of the following:

The total amount of money the mutual fund has borrowed divided by the number of people who own shares in the mutual fund

The total value of the fund's assets divided by the number of people who own shares in the mutual fund

The correct answer is #2: The total value of the fund's assets divided by the number of people who own shares in the mutual fund

14.7: The money market fund is a special type of mutual fund that invest only in:

High risk and long-term investments

High quality short-term investments

Real estate investments

The correct answer is #2

Money market funds are limited by law to certain high-quality, short-term investments.

14.8: Which one of these items is not true about a mutual fund classified as an index fund:

The fund offers returns similar to returns of an index such as the Dow Jones or the S&P 500

The fund offers returns similar to a particular stock within an index such as the Dow Jones or the S&P 500

The correct answer is #2

The questions asks which of the statements is not true. An index fund offers returns similar to an entire index, not returns similar to a particular stock in that index.

14.9: One of the reasons that mutual funds are not always Teenvestor-friendly is that:

Mutual funds require a portfolio manager

Mutual funds often require investments of $1,000 or more

Mutual funds often invest in a diversified pool of stocks and bonds

The correct answer is #2

14.10: A fixed income fund is a fund related to one of the following:

Stocks

Bonds

Mortgages

The correct answer is #2

Anytime you see the words "fixed income", think bonds.

14.11: A prospectus is which of the following:

A document which contains information about costs, risks, past performance, and the fund’s investment goals

An special type of investment in stocks

The correct answer is #1

14.12: True or False. A mutual fund sales load represents the commission buyers of mutual funds pay to those who help them buy the funds. The correct answer is True.

A mutual fund charges a sales load to pay commissions to the people who sell the fund’s shares to investors, as well as to pay other marketing costs.

14.13: True or False. A front-end load is a type of sales load you pay when you sell your mutual fund. The correct answer is False.

A front-end load is a sales load that you are required to pay when you buy shares of a mutual fund.

14.14: True or False. A back-end load is a type of sales load you pay when you buy mutual fund. The correct answer is False.

A back-end load is a sales load that you are required to pay when you sell shares of a mutual fund.

14.15: True or False. Besides a sales load, funds also charge other fees called an expense ratio for managing the fund. The correct answer is True.

14.16: True or False. The 12b-1 fee is a marketing and distribution fee charged by mutual funds included as part of the expense ratio. The correct answer is True.

14.17: True or False. The higher the sales load and expense ratio, the higher your returns on your mutual fund investment. The correct answer is False.

Funds with high expense ratios do not typically perform better than those with low expense ratios.

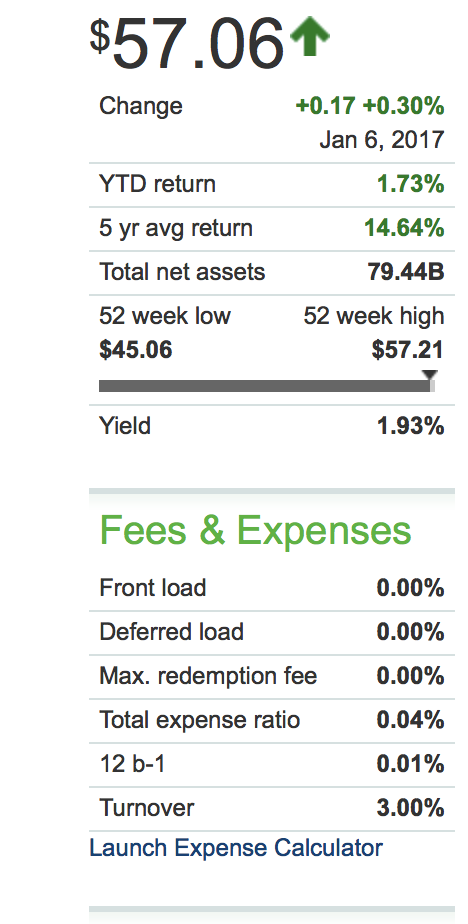

14.18: Log into MarketWatch and enter the mutual fund symbol, VITSX, in the search box. VITSX is the Vanguard Total Stock Market Index Fund which is one of the biggest index mutual funds. Please list the following:

We took a snapshot of the VITSX mutual fund on January 8, 2017 as shown in the graphics below.

The NAV of the fund ($57.06)

Total net assets of the fund ($79.44billion)

The expense ratio of the fund (total expense ratio is 0.04%)

The 5-year average annual return (14.64%)