Teen Investors and Exchange-Traded Funds

Modified: July 21, 2023

Teen Investing in ETFs

Exchange Traded Funds (ETFs) are investments that represent a diversified group of companies that trade just like stocks. They have been around since about 1993, which is a short time for an investment product.

Stocks are great, but some teen investors are uncomfortable researching and choosing stocks independently. Some feel overwhelmed by the massive amounts of financial information produced by companies. Exchange-traded funds or ETFs may be the perfect investment for teen investors who don't have the knowledge or the time to choose stocks for their portfolios.

Types of Exchange-Traded Funds (ETFs)

There are currently over 3,000 ETFs on the market. Since the beginning of ETFs, we have seen the emergence of new types of ETFs besides equity-based (stock-based) ETFs and fixed income (bond-based) ETFs. There are now ETFs based on cryptocurrencies, commodities (like gold and oil), currencies, real estate, and many other assets.

ETFs vs. Mutual Funds

ETFs and mutual funds are very similar in that they both represent investments in a group of stocks or other assets. However, there are a couple of differences that make ETFs superior to mutual funds especially for teen investors, who typically have very little money at their disposal.

The great thing about ETFs is that they are traded on exchanges through online brokers just like stocks. Teen investors can invest as little as $5 in an ETF if they choose to do so because many online brokers allow for fractional share investing. In other words, you can buy a small percentage of any ETF or share on their investing platforms.

By contrast, an investor who wants to buy or sell mutual fund shares must do so through a fund manager (such as Vanguard). The fund manager will only execute that trade at the end of the trading day (no matter what time that day the investor placed the buy or sell order). In addition, teens who want to invest in mutual funds will have to shelve out as much as $3,000 for their initial investment. There are simply not too many teen investors who can afford such a big investment.

Index-Based ETFs

The best types of ETFs for teen investors are those that try to mimic the stocks in a market index that represents the overall stock market. For example, a popular ETF is the Vanguard 500 Index Fund, which tracks the stocks in the Standard and Poor’s 500, an index of the 500 biggest companies in the United States. Other index funds represent the broad stock market. However, for teen investing, you should stick to ETF that diverse stock holdings, like those in the Standard and Poor’s 500 Index, the Dow Jones Industrial Average, and the NASDAQ.

Index-Based ETFs and Diversification

One of the most important reasons for teens to invest in an index-based ETF is because of something called diversification. Diversification is investing in several different stocks (for example, stocks in various industries) so that a decline in the value of one stock does not necessarily affect the value of the other stock in your portfolio.

A broad market index-based ETF hold so many different stocks that a decline in the value of any one stock will not affect the value of the other stocks in the fund. For this reason, teen investors would come to appreciate that index-based ETFs are less risky than investing in the stocks of one or two companies.

As a simple example, let’s suppose you bought Amazon stock on July 8, 2021 at its closing price of about $$186.57 (the price it was selling for that day). By December 14, 2022, the stock was down to $91.58 – a 51% decline in value.

By contrast, let’s suppose you bought the Vanguard 500 Index Fund ETF (which relates to the Standard and Poor’s 500 index) on July 8, 2021 at its closing price of about $388.82. By December 14, 2022, the fund price was down to $367.16 – a mere 6% decline in value.

To summarize, Amazon’s stock declined by about 51% between July 8, 2021 and December 15, 2022 but the Vanguard 500 Index ETF only declined by 6% in the same period. As you can see, buying an ETF based on a broad market index can protect you against significant declines in the value of your investments.

Top Index-Based ETFs for Teen Investors

As I previously discussed, a teen investor should stick to index-based ETFs only. The top 3 ETFs that represent the broad stock market in the United States are as follows:

Vanguard 500 Index Fund: This ETF is based on the Standard and Poor’s 500 Index which represents the price movements of the top 500 companies in the United States.

SPDR Dow Jones Industrial Average ETF Trust: This ETF is based on the Dow Jones Industrial Average which is considered a broad market index for stocks in the United States; it is the oldest stock in the United States and consists of the stock of 30 large companies.

Invesco QQQ Trust: This ETF is based on the NASDAQ index which is a broad market index that heavily represents movements in the value of high-tech stocks.

Getting Information on Exchange-Traded Funds

You should get information on each of the exchange-traded funds listed above. I use the website, Finance.yahoo.com to get the price of each share of the ETF and other essential data necessary for your investment decisions.

For data on ETFs, you first need the symbols associated with each one. The symbols associated with each of the index-based ETFs listed above are as follows:

To get information on each ETF, plug the stock symbol into a financial website like finance.yahoo.com. For example, the information for the Vanguard 500 Index Fund (which has VOO as its symbol) is as follows: Vanguard 500 Index Fund.

You can get the following information from this link:

The current and historical price of the fund;

The fund overview; and

The top holdings of the index fund, how the fund is performing, and other information about the fund.

Consider the Expense Ratio of the ETFs

Not all ETFs are created equally. One important thing a teen investor should consider when investing in any ETF is its expense ratio. Each ETF must be managed by investment advisors who decide what stocks to include in its portfolio. This expense ratio covers the cost of the investment advisors and managers.

For broad index-based ETFs (such as those that track the Standard and Poor’s 500 Index), the expenses are pretty low since all a manager has to do is include the stocks in the index in the ETF pool. So, for broad-market index funds, expense ratios are relatively low because they require less attention.

Index Funds With the Lowest Expense Ratios

For example, the expense ratios for Vanguard 500 Index Fund, SPDR Dow Jones Industrial Average ETF Trust, and Invesco QQQ Trust are 0.03%, 0.16%, and 0.20%, respectively. These are the hidden costs you are paying for investing in these funds. The cost of the Vanguard 500 Index Fund is particularly low because Vanguard is known for keeping costs low for its clients. The other two ETFs are also low compared to the exorbitant amounts charged by other ETFs.

By way of comparison, an ETF related to financials called the Invesco KBW High Dividend Yield Financial ETF (symbol: KBWD) has an expense ratio of 2.59%. This is criminally high and it means that over a long period of time, you will be burning money just for the privilege of have expensive investment managers manage your ETF.

This is precisely why teen investors should stick to ETFs related to simple broad market indexes like the Standard and Poor 500 Index or the Dow Jones Industrial Average. There are no special skills for investment managers to maintain these ETFs so they are much cheaper for you and you will benefit in the long run.

Returns of Index-Based ETFs

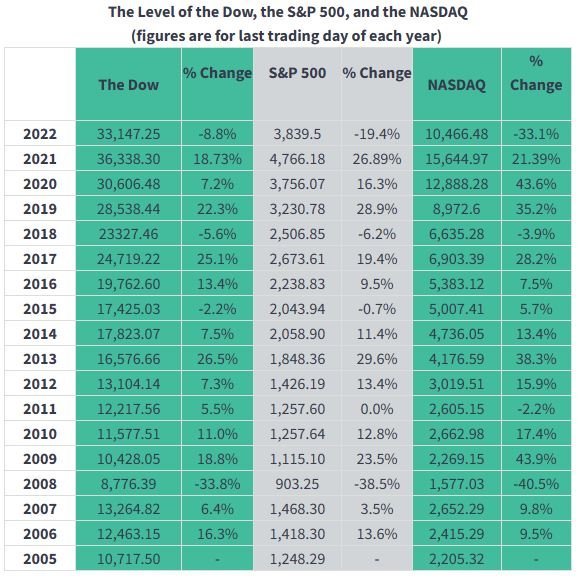

Let’s say, for example, you invested in an index-based ETF that tracks the Dow at the end of 2018, your return by the end of 2019 would be close to 22.3% as shown in the table (in the “% of Change” column for the Dow for 2019).

The returns can change from year-to-year, however. For example, if you’d invested $100 in an ETF index that tracked the Dow at the end of 2007, your $100 investment would have lost you about $33.80 (or 33.8% as shown in the table in the “% of Change” column for the Dow for 2008). Over a long period, however, the overall return of an index exchange-traded fund based on the Dow would be positive.

Most ETFs trading in the marketplace are index-based. An index, as I explained earlier, is used to gauge the movement of the broad market. Some of the index-based ETFs seek to deliver the same return as the major US indexes like the Dow, the S&P 500, and the NASDAQ (further described in the linked page) as shown in the table below.